Presidential Candidates Stance On Real Estate

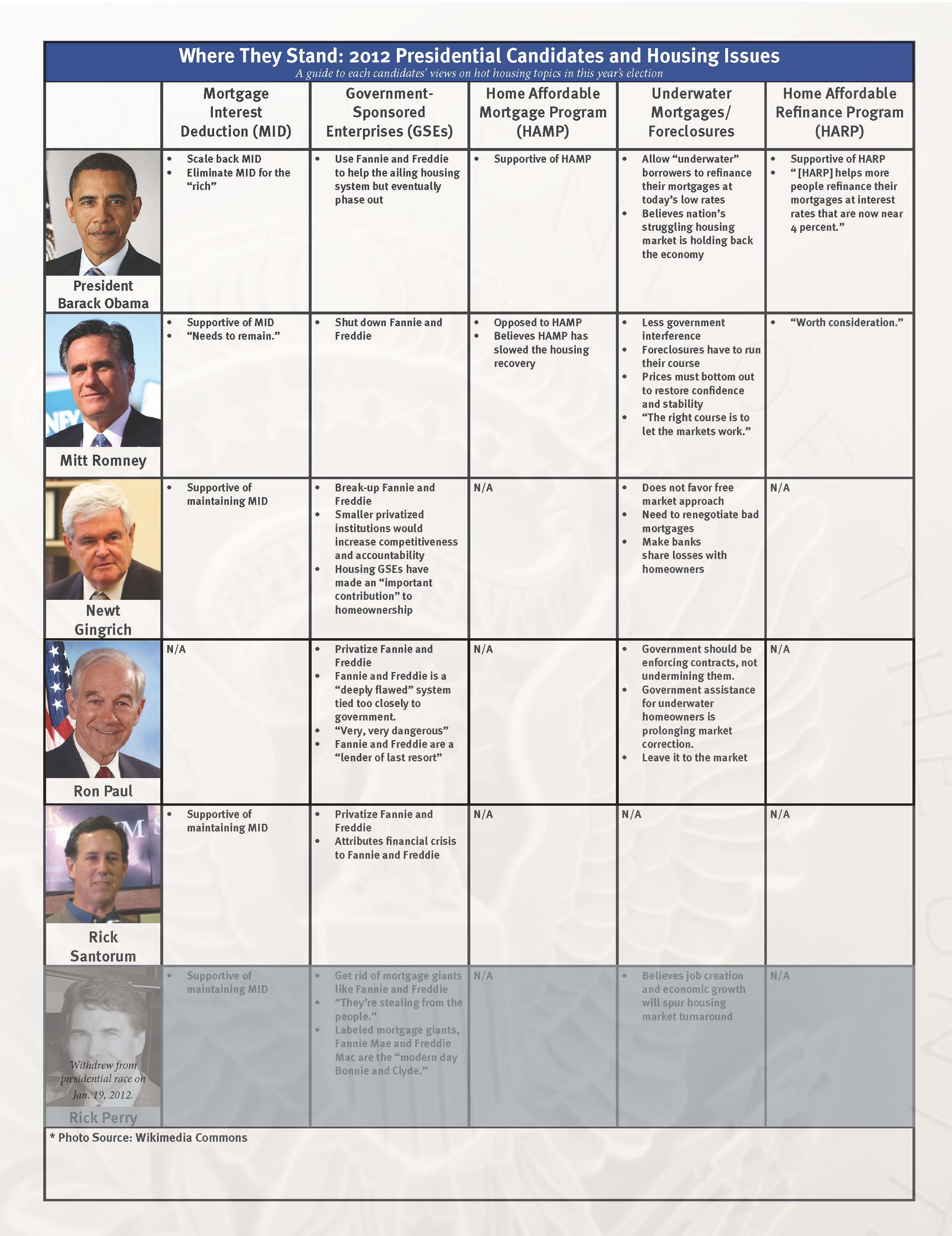

Last week Zillow posted a blog with the views of our presidential candidates on housing and real estate issues. I thought it was good information, so I thought I’d share the chart from Zillow. I’m not going to take a political stance here, because I don’t completely agree with any one of the candidates. However, I will share some of my personal views on these topics.

My views on some of these things are probably quite different from most real estate agents or investors. I try to think about what is best for our country as a whole in the long term rather than what’s best for my sales as a Realtor or my interests as an investor.

Mortgage Interest Deduction – We own investment property, and currently claim mortgage interest deductions on several properties. While this deduction is a great incentive for the housing market, I do think that there should be a limit. If a person’s net worth is over a million dollars, do they really need a tax break for caring a mortgage? Probably not, they could just pay off your mortgage and avoid interest all together. I tend to feel the same way about the PMI deduction. I’ll take advantage of these while they are available, but I don’t think they are necessary for those that could afford to own a home without having a mortgage.

Government Sponsored Enterprises (Fannie Mae and Freddie Mac) – I’ll be honest; I don’t have a solution in mind for this mess. I do think that the government should have less involvement in the secondary mortgage market. Investors would still buy mortgage backed securities with or without the government’s involvement. I just think banks need to lend based on good judgment and their own qualification guidelines rather than the requirements of the government (which have gotten us in trouble in the past). I realize that less involvement from the government may cause further damage to the housing market in the short term, but I think it would work out for the best in the long run.

Making Home Affordable Programs – HAMP, HARP, and underwater mortgages all fall under the making home affordable programs. I’m not a big fan of loan modifications that reduce principal or cut interest rates below the industry norm. While, I feel for all those have suffered true financial hardships, l think modifications will end up costing tax payers and create additional banking turmoil. On the other hand, I do like some of the refinance programs. The lending market has become rather difficult. If we make it easier for qualified people to refinance to current lower mortgage interest rates, this should lead to fewer foreclosures in the future and economic improvement.

Back Home

Back Home

Leave a Reply

You must be logged in to post a comment.