Should I wait to buy a home because prices are high?

I get this question all the time from first time home buyers. Or I hear, “I’m just going to wait until the market turns down, then I’ll buy”. Nobody wants to buy at the peak of a market and everybody wants a good deal, but is there really logic to waiting?

To answer this question, I looked back at data from previous recessions. The only significant price drops I could find (aside from the 2008 housing crisis) were World War I, the Great Depression in the 1930s, and World War II. In the early 1990’s prices flattened, and inflation adjusted prices actually decreased but nothing like in 2008. During the 2008-2012 recession, Dane County median prices had peaked at $217,500 in 2007 and then dropped to $200,000 in 2012. While other areas of the United States lost 50%+ in housing value, homes in the Madison area only lost 9.2%. This shows you Dane County (and the Midwest in general) is far less cyclical than many other markets across the US.

I’ve been hearing people say “the market is too hot, I’ll keep renting” for at least three years now. Over the last 3 years median prices in Dane County are up 18.9% (based on WRA statistics). Since 2014, we have been exceeding 5% per year gains in home values with some local areas hitting 8-10% gains. This is certainly better than average and primarily due to low interest rates and low inventory. Those people that didn’t want to buy for the fear of an extreme rare possibility of a loss missed out on a 18.9% gain. Historically, Wisconsin has averaged closer to 4% per year increases in housing prices.

We are due for an economic pull back at some point. However, housing looks totally different now as compared to 2007. This time around, there’s a shortage of inventory rather than an abundance. The banks are tight on lending practices rather than just handing out money. Even if the housing market pulls back along with the rest of the economy, I think it will be more of a flattening in prices rather than a significant decline.

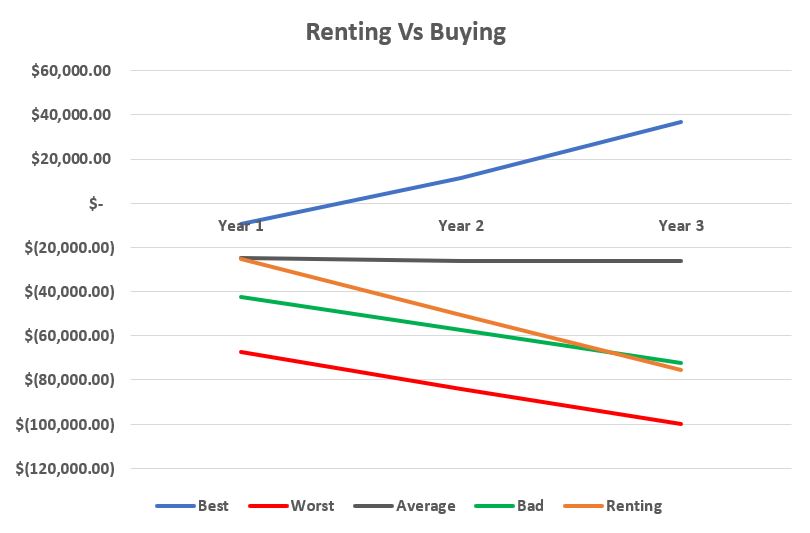

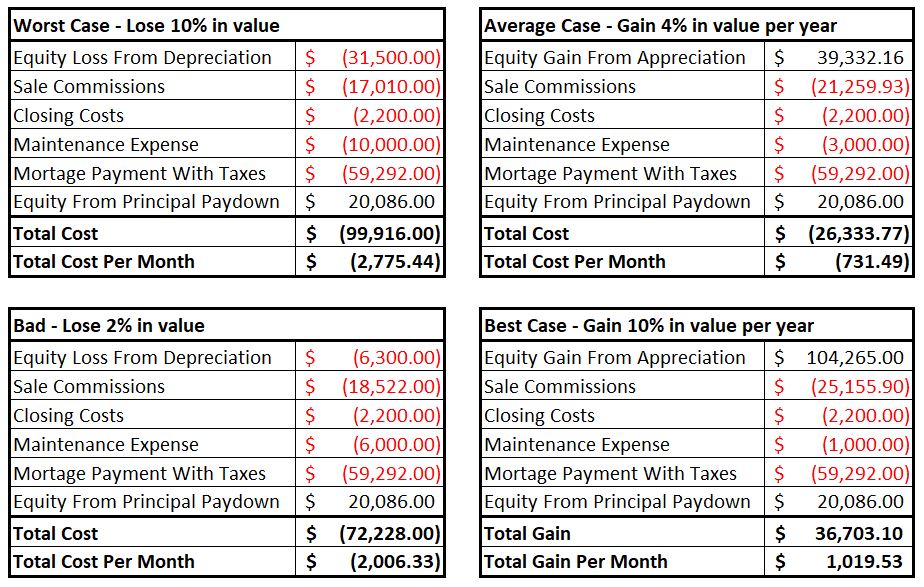

Even if the housing market lost 10% in value again, how would home ownership compare to renting? I charted 4 scenarios below. In each instance I used the median $315,000 home and I factored in the costs associated with owning and selling – maintenance expenses, mortgage payment (based on today’s 2.75%), taxes, appreciation (or depreciation), and equity gained from paying the principal on your mortgage. In the rental scenario, I just assumed you were spending $2,100 per month to rent a $315,000 house.

You can see that by year 3, the worst-case scenario of a ‘once in 80 year 10% loss’ is the only scenario that ends up worse than renting. …and to be this bad you would have to time it just right, buying at the peak and selling at the bottom. History shows that if you held onto your home for 5-7 years, even this worst case would have a positive outcome.

You can see that by year 3, the worst-case scenario of a ‘once in 80 year 10% loss’ is the only scenario that ends up worse than renting. …and to be this bad you would have to time it just right, buying at the peak and selling at the bottom. History shows that if you held onto your home for 5-7 years, even this worst case would have a positive outcome.

With an abnormally bad 3 year stretch where home values drop a cumulative 2%, results in a total cost just slightly less, but almost equal to renting. An average case of 4% per year appreciation ends up costing you a net of $731/month saving you $1,361/month over renting a similar house. I projected the average case out over 5 years at which point it ends up basically net 0, in other words you had free housing and were $2,100/month better than renting. A rare, best case scenario has you living for free and gaining $1019/month. None of this factors in the big gains you’ll see if you are staying in a home for 10+ years. You can clearly see why studies show that the average homeowner ends up with a net worth 40 times the average renter.

So what do all these number mean you ask? If you plan to stay put for at least 3 years you are almost always better off owning vs renting. You shouldn’t let the ever-increasing home prices hold you back from buying. I’ve been guilty of holding back myself when it comes to our real estate investments. Three years I ago I said I’ll buy more investments when the market calms down. Now I kick myself looking at the deals I passed. This year we bought 2 more investment properties because we firmly believe in the future of real estate. If you aren’t financially stable or you haven’t settled in one place yet, it probably makes sense to keep renting, but work to get yourself in position to buy in the near future.

Back Home

Back Home