Is Buying a Home a Good Investment?

There has been much debate over whether owning a home is a good investment or not. Dictionary.com defines investment as “the investing of money or capital in order to gain profitable returns, as interest, income, or appreciation in value.” Historically real estate has had an annual average rate of appreciation between 3.5% and 5% depending whose numbers you look at. Does that mean it’s a good “investment”? Maybe not when you factor in the average rate of inflation over the past 100 years has been about 3.4%. I think it’s safe to say that average real estate appreciation is pretty close to the average rate of inflation (maybe slightly better). So from the standpoint of an investment analysis this doesn’t look so good.

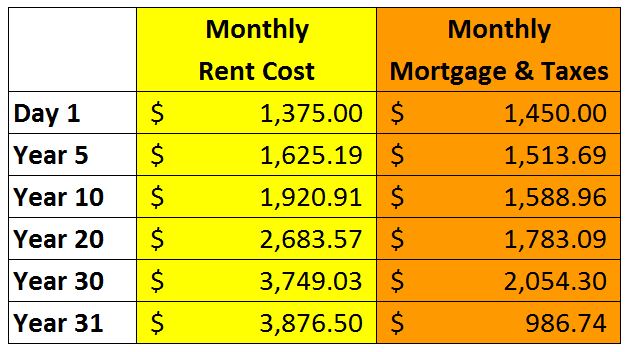

What’s the alternative to owning a home though, renting? Let’s look at a comparison of renting versus owning over the life of a 30 year fixed rate mortgage. The chart below shows monthly costs of renting vs owning an average 3 bedroom home in Madison, WI. This assumes that rent and property taxes increase along with the rate of inflation, and a 30 year fixed rate loan of $225,000 at 4.2% on a $250,000 property.

As you can see, it may be slightly cheaper to rent now, but over the long term the cost of rent goes up far more than your house payments. This is because your mortgage rate is fixed, and your property taxes are the only thing increasing if you own a home. By the time your mortgage is paid off in year 31 it would cost you $2889.76 more per month to rent then it would to pay your property taxes. Also if you were in the homeowner’s shoes rather than the renter’s shoes you would now own an asset worth over $681,000.

While owning a home isn’t really a great investment in the true definition of the word, it is a great way to save money over time, protect yourself from inflation, and build long term wealth. A home is not really intended to be an investment; its a place to live. We all need a place to live and you will be much better off financially owning a home as compared to being a renter. It is better to have a large asset in the end than it is to have nothing at all, and it’s better to lock in your payments than pay an increased amount of rent every year.

There are many forms of real estate investment that could be considered a true investment such as owning rental properties, or rehabbing/flipping properties, or developing properties into something of greater value. All of these things are more geared towards actually making a profit on your money. Your home that you live in may not do that, but again it will get you further ahead than renting.

Back Home

Back Home

Leave a Reply

You must be logged in to post a comment.