Saving For a Down Payment

I’ve been asked several times by potential buyers “Do people really put 20% down on a house? How does someone save $40,000 or more?” It’s not really necessary or the norm these days to have a 20% (or more) down payment, but it is possible and people do it all the time.

I’ve been asked several times by potential buyers “Do people really put 20% down on a house? How does someone save $40,000 or more?” It’s not really necessary or the norm these days to have a 20% (or more) down payment, but it is possible and people do it all the time.

Let me start by saying there are plenty of loan programs out there that allow for lower down payments. There are even some loan programs that still allow 0% down. Don’t rule yourself out of the house buying market if you are ready to buy but don’t have a big down payment. Although, you will be in a much better position with a larger down payment.

With a 20% down payment you will:

- Qualify for the best interest rates.

- Avoid private mortgage insurance, an extra monthly fee to protect the lender.

- Put yourself in a more secure equity position, allowing you a safety net if the market drops or you need to refinance.

Three things that will help you save for a down payment are:

Budgeting

The most important factor in saving for a down payment is to spend less than you make. Many people tend to spend every penny that comes in just because it’s there, and they don’t really have a plan for their money. I recommend people create a budget and track their spending, and this will help you determine where you can cut back and how much you could be saving.

If you have never done a budget before, make a list of all your planned spending on paper or in software (I like Mint.com as a free tool) and balance that spending with your income. Any extra income should be allotted towards savings. The first time you do this there will be a fair amount of estimating and guessing. Although, after you track your expenses for a few months, you should be able to keep adjusting your budget to get more and more accurate. Feel free to download our Budget Sample form to help you get started.

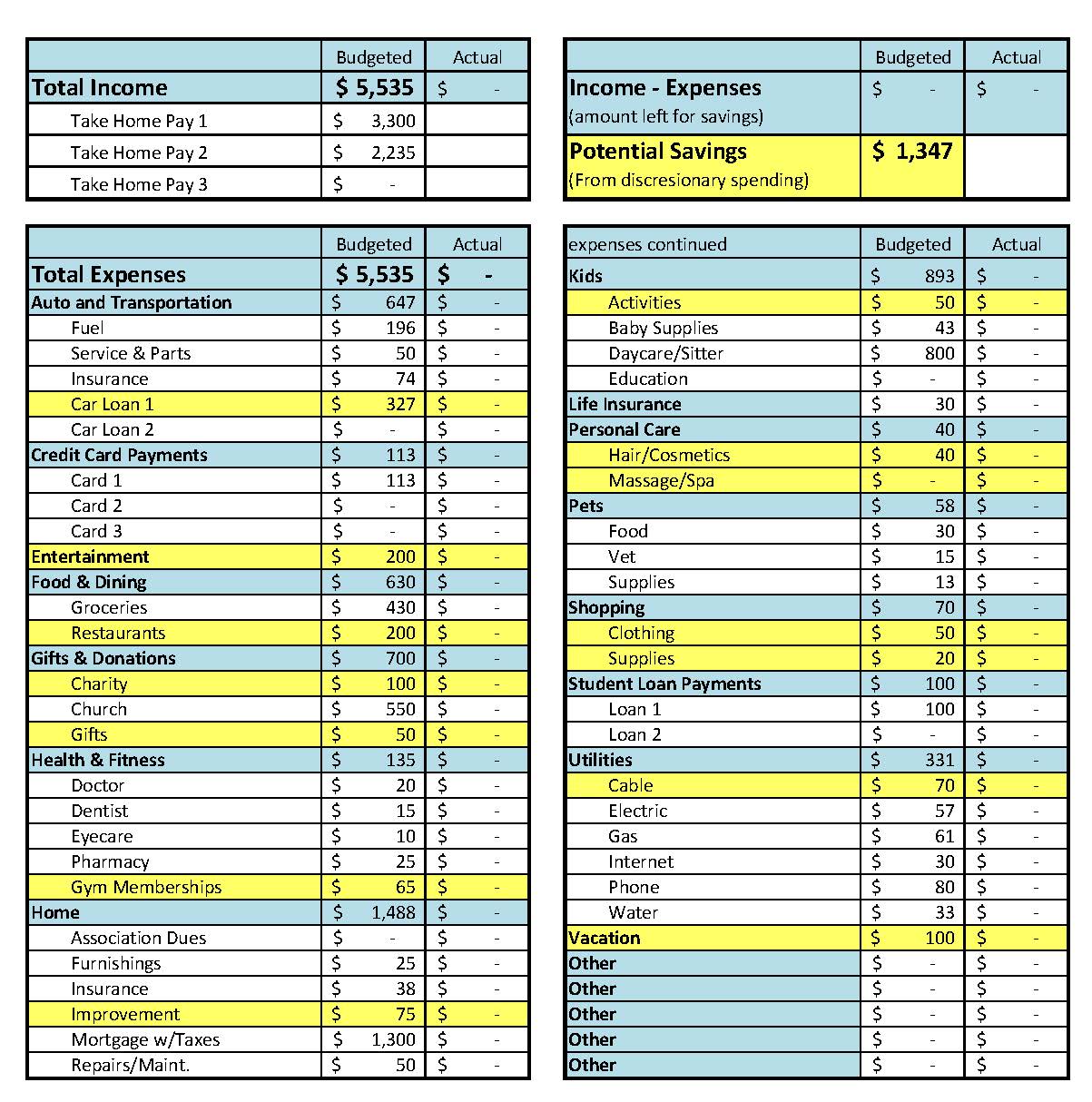

Below is an example of a couple that has 2 incomes totaling $5,535 in take home pay. You can see they have balanced their budget, but they don’t have any money categorized for savings. I have highlighted items in yellow that in my opinion are discretionary. If they wiped out all discretionary spending they could potentially save $1,347 per month. Most people aren’t going to strip out every ounce of extra spending in their life. However, if this couple chose to drive a cheaper (paid for) car, limit their entertainment and restaurant spending, and maybe even cut out their cable TV, they could easily save $500-$600 per month.

Now that you have freed up $500+ a month, you could quickly get your other debts paid off such as student loans or credit cards, and that would free up even more money every month. At that point, your savings account can pile up really fast.

Extra Work

Depending on which statistics you look at, the average American spends between 2 and 7 hours a day just internet browsing or watching TV. This means there’s plenty of time in your life for a little extra work. If your current employer has enough work for you, volunteer to pick up a few hours of overtime. If overtime isn’t an option, you could start a side job waiting tables, delivering pizza or anything that is flexible enough to work around your primary job.

The other option for extra work would be to start your own business on the side. I know several people, including myself, who have had great success starting businesses while still working a primary job. In fact this is how most businesses start. If you have a hobby or something you really enjoy, consider if it’s possible to turn it into a profitable side business. Who knows it could turn into something bigger.

Most people are very resistant to picking up extra work, but working a couple nights a week or one day a weekend can make a huge difference in your financial picture. This is all extra income that you are not currently planning on. This means you should be able to throw every extra penny you earn into savings (or towards paying off debt).

Sell Stuff

If you are like most people you have a lot of things you think you need, but you don’t really use. Or you’ve just been too lazy to sort through all the things that have been stashed away in your basement. We have been working on cleaning out our basement, and I’ve discovered lots of things that we don’t use. For example, why do I have a weight bench when I have a gym membership (one of those two things should go)? Why do we have hundreds of books that we’ll never read again? Why do I have a baseball card collection that has been boxed up and moved around with me for the last 18 years? All this stuff is going to go. If we haven’t touched it in a year, we don’t need it. So, go through all your unused items and see what you can sell. I’m sure your items are worth something to somebody on craigslist or eBay.

The bottom line is start paying attention to your spending, make a budget, sell a few things and you’ll be amazed at how fast you can save up some cash. A few small sacrifices really go a long way to saving and making a better future for yourself.

Back Home

Back Home

Leave a Reply

You must be logged in to post a comment.