Income Property Analysis – Cashflowing Duplex

Have you ever considered rental property as an investment? An income producing property can be a great long term investment by providing a little bit of cashflow, monthly equity gains, and hopefully appreciation and tax savings (though there’s no garauntee to those two). At the same time it helps protect you from inflation. You see, a building is really a bundle of commodities (building materials), and during inflationary times the cost of those commodities increases and so does your real estate. Lastly, the tenants pay your mortgage and when the property has finally paid itself off, you end up with a great deal of equity and a really nice income from the cashflow.

Appreciation over the long term can turn into a huge profit. Even though the historical average has been about 4% appreciation per year, I tell people don’t plan on that. You could get caught in a declining market like the past 5 years, and if you were banking on appreciation you’d be in a losing situation. Always make sure a property makes sense the day you buy it from a cashflow perspective.

Similar things can be said about the tax advantages. While there are currently some nice tax benefits to income property (depreciation, deductible mortgage interest, etc), you can’t count on the fact that the tax code won’t change. In addition, you do actually have to reclaim your depreciation when you sell, unless you do a tax deferred exchange.

So, when I look at income property I really focus on the cashflow and equity gain from principal paydown. I consider any other income or tax savings just an added bonus.

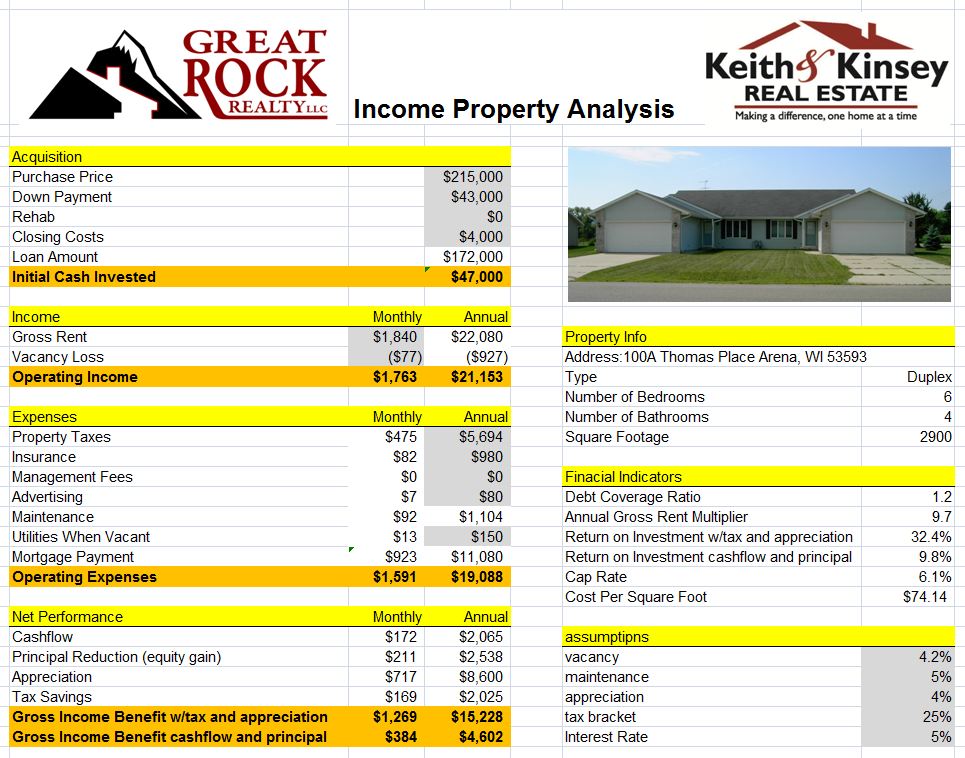

So, how do you analyze an income property? We have an income property analysis spreadsheet (some people call it a pro forma). We take the income minus a vacancy factor and we subtract the operating expenses to get our actual cashflow. We can aslo calculate the equity gain from principal reduction based on a mortgage amatorization schedule. You should note that you will reduce your loan balance at a faster rate every year due to a lower balance and thus lesser interest ever year. These means that your equity gain will increase as the months go by (the first year is the least amount of equity gain).

Take a look at this example below of one of our properties that is available for sale. This property would return 9.8% of the initial investment in the first year based only on cashflow and principal reduction. If you did factor in an average appreciation rate of 4% and the current tax savings, the property would return 32.4%. So count on 9.8%, but it would likely be higher. I should also point out that you can definitely find properties with a higher return on investment (ROI). However, the properties with a better ROI are often in worse condition and worse neighborhoods. It’s pretty typical that the ROI goes down as the quality of property goes up. This is because a higher quality property requires less work and results in fewer headaches.

I’m a conservative investor, so I used fairly safe numbers. I also prefer not to be highly leveraged. So, I would recommend putting 20% down on any investment property, or more (pay cash if you can). Of course the more you put down the lower your rate of return is because your initial investment is higher, but you end up with less risk.

Another great possibility for a first time investor would be to buy something like this duplex and live in one half. Being an owner occupant, you’d have the availability of lower interest rates, lower down payments, and all around better financing. This would allow you to have the tenant paying well over half of your ownership expenses, while you end up with a cheap place to live.

The options and possibilities are endless with investment properties. If you are interested in this property or learning more about investing in income property around the Madison area feel free to contact us. I’d be happy to share my analysis spreadsheet too.

Back Home

Back Home

Leave a Reply

You must be logged in to post a comment.