2022 Real Estate Market Summary and What’s to Come For 2023

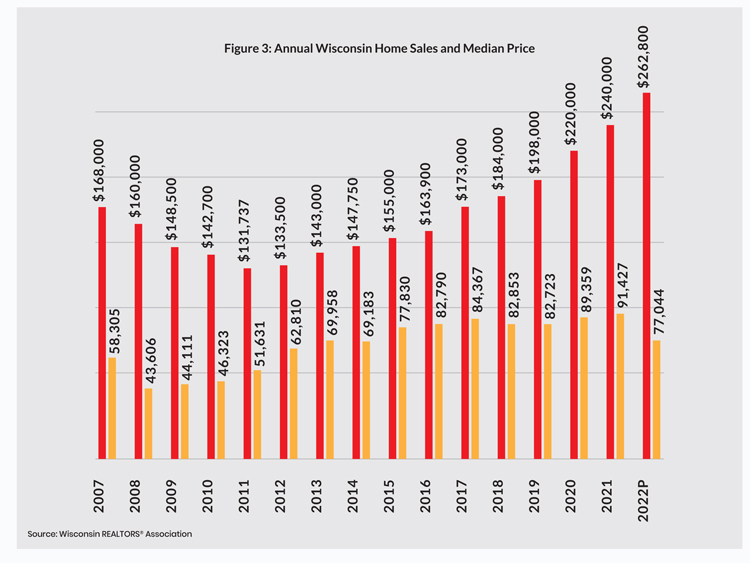

The early half of 2022 was fueled with extreme bidding wars and buyer competition driving prices up 9.5% statewide and 9.7% in Dane County and the Madison area. The latter half of the year (especially the 4th quarter) had a significant slowdown due to rising interest rates and lower affordability. Even though prices were up significantly for the year, the median price was only up 2% this December vs last indicating a pullback in prices from the summer months.

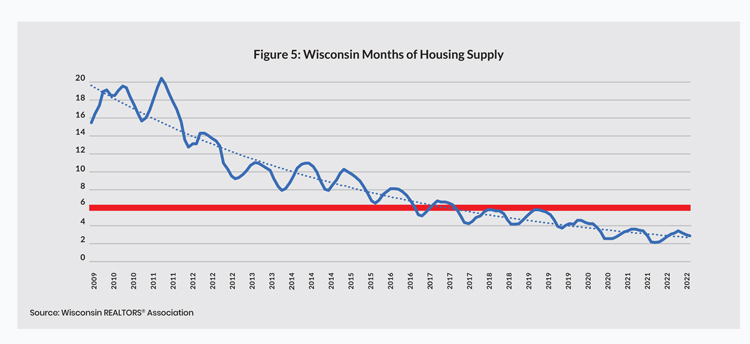

The average sale price for the year was 1.2% above the average asking price, but the average sale price in December was 1.9% below the asking price. This calm down is a good sign for buyers. We are back to the days where a buyer can at least ask for an inspection and appraisal without getting pushed aside for a more favorable offer with fewer contingencies. Although we are still seeing only just shy of 2 months’ worth of inventory in Dane County and just over 2 months statewide. Additionally, the median days on market in Dane County was only 20 days in December. These stats are still indicating a seller’s market. If you look at the chart below, 4-6 months supply is generally considered a neutral market and 6 months or more (above the red line) is a Buyer’s market. You can see that we’ve been skewed in the sellers favor in terms of inventory for quite some time. Sales for the year were down 14.6% indicated fewer homeowners are moving which is not helping the supply of available homes.

While we don’t have a crystal ball, we think demand will continue to outpace supply and keep things in the seller’s favor despite higher interest rates. However, gone are the days of expecting 15 offers within a matter of days, some with no continencies. A seller will need to be more realistic on pricing and may need to be a little more patient waiting for an offer. Homes should still move relatively quickly and fairly close to asking price compared to historical norms. We are just talking 1-3 offers within 3-8 weeks will become more common rather than 15 offers in 3 days. A buyer may have more opportunity to negotiate and the chance to get a better deal while avoiding the extreme competition. If interest rates take a significant turn back down, we could see the crazy bidding wars reappear. While we’d all like rates to dip, they were artificially low from too much political pressure and stimulus. I think 4-7% rates create a healthier economic stability and should make for a more balanced housing market going forward.

Back Home

Back Home

Leave a Reply

You must be logged in to post a comment.