Madison Area Real Estate Market: Your October 2025 Reality Check

You may be hearing national headlines about a real estate meltdown, falling prices, and cooling sales. While the Madison area real estate market has certainly experienced a significant cooling, Dane County is clearly bucking some of the national trends.

Initially, I tried using some AI tools to help write this update. However, when I asked both ChatGPT and Gemini for local statistics, the feedback I received raised red flags. So, let’s dig into the real numbers, which I’ve pulled directly from MLS sales records through the end of September 2025. Note: This analysis strictly looks at single-family home sales and excludes condos.

Days on Market and Inventory: A Shift Toward Balance

The two biggest negative changes for sellers are Days on Market (DOM) and Inventory.

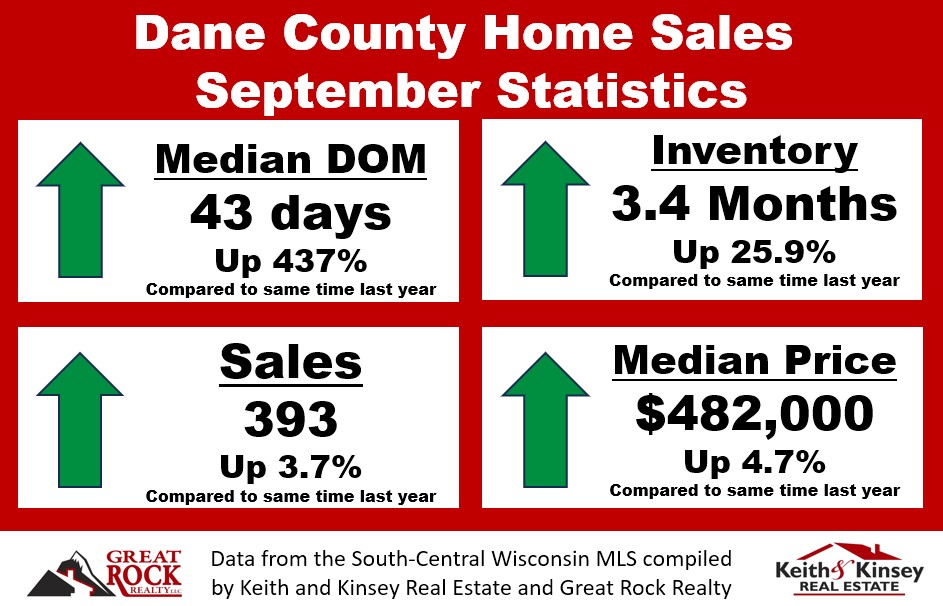

- Last September, the median DOM was a lightning-fast 8 days; this year, it was 43 days—a whopping 437% increase.

- Inventory last year at this time was around 2.7 months; currently, it’s at 3.4 months—an increase of 25.9%.

These massive shifts might lead you to believe the sky is falling, right? Not at all. Generally, 4–6 months of inventory and 45–60 days on market would be considered a truly neutral market. As a real estate broker, I believe a neutral market is the most healthy market, as buyers and sellers have equal negotiating power and motivation, and we don’t see runaway price inflation.

Even with these big changes, the current statistics still show the market is in the seller’s favor, although it is certainly approaching neutral territory.

Sales Volume Remains Low and Pricing Remain Strong

Now let’s take a look at sales. Total sales volume is up a minimal 3.7% year-over-year. I would argue this volume is still low, a direct result of tight inventory and worsening affordability over the last few years. The average number of September sales over the previous 10 years was 498, or 26.7% higher than current levels. If sales were to rebound to normal levels, that would again make inventory lower and prices shoot higher due to natural supply and demand.

Despite the market cooling, median prices are still up 4.7% year-over-year, which is more than the historical average, though certainly less than the 8–10% we’ve seen in recent years. If you were a buyer in the Madison area just five years ago, you’ve seen a staggering 41.6% increase in your home’s value. This combined with higher interest rates is what has created the current challenge with affordability.

The Bottom Line

If you are a seller, conditions are still in your favor. You’ve simply grown accustomed to the expectation of your house selling in a week and way above the asking price. While that may still happen in some situations, that’s not the norm or the expectation today.

If you are a buyer, as the market shifts closer to neutral, you have a better buying opportunity than you have had in recent years. I would advise taking advantage of that now, because if interest rates come down and sales volume rebounds, this will increase demand and send us the other direction again.

Quite honestly, I would love to see the median days on market around 55 and inventory around 5 months. I think that would get us back to a healthy, normal market. We might get there in the dead of winter, but I don’t think it will last through the Spring of 2026. Who knows, falling interest rates, while increasing demand, could loosen inventory if more current homeowners feel they have a better potential to upgrade. Only time will tell.

Do you have any questions about the data or want to dive deeper into what this means for a specific neighborhood?

Back Home

Back Home

Leave a Reply

You must be logged in to post a comment.